Graduate students received financial assistance from President Obama’s student loan debt relief plan last month. Originally, this was supposed to take place on Jan. 2014, but in the midst of the tuition and loan crisis students will see their financial loans lessen this year.

In a public address to university grad students Obama said that over the past three decades the cost of college has nearly tripled for students and last year graduates, who took out loans, left college owing an average of $24,000.

Student loan debt has surpassed credit card debt for the first time ever, according to a report from CBS.

Income-based loans

Obama’s student loan relief plan will be split into two measures, the first one being a special loan repayment program based on income that aims to help struggling graduates.

Former grad students had to pay 15 percent of their monthly income to their loans and debt were forgiven after 25 years. Now, students only have to pay 10 percent of their income to loans and debt will be forgiven after 20 years – resulting in lower monthly payments, according to the White House’s report.

“The question to ask is whether the graduate degree will increase their income by enough to allow them to make payments on their loans,” said Shirley Svorny, CSUN economics professor. “Only make an investment (in loans) if the expected return covers the cost.”

Joyce Smith, a graduate student, who earned her bachelor’s degree in business management from National University in 2011, will be attending CSUN master’s program in the fall.

“I owe $30,000 in my loans from my undergraduate degree alone. My advice to students who are college bound or students attending college currently is to take the loans that you can afford to pay back,” she said. “Don’t take out private loans from banks because the interest rates are very high. Instead look into scholarships and grants to help you pay for college.”

Student loan consolidation

The second measure would encourage graduates with two or more different kinds of federal loans to consolidate their loans by lowering the interest down to 0.5 percent. This will in turn lower their monthly payments and save the hundreds of dollars in interest, according to the White House Report.

The Obama administration said that 1.6 million Americans whose income is sufficiently low will benefit from the lower monthly payments, and upwards of 6 million can take advantage of the loan consolidations.

Armenka Khashman, assistant director of CSUN financial aid and scholarship department, said that students can contact their loan service provider to sign up for the debt relief plan.

“I recommend that students keep track of their loans by going to the National Student Loan Data System at the federal student aid site so they can know how much they owe,” she said. “Also to minimize the cost while they’re in school they should attend school full-time if possible and research scholarships before deciding what to borrow.”

Grad thoughts on debt loan plan

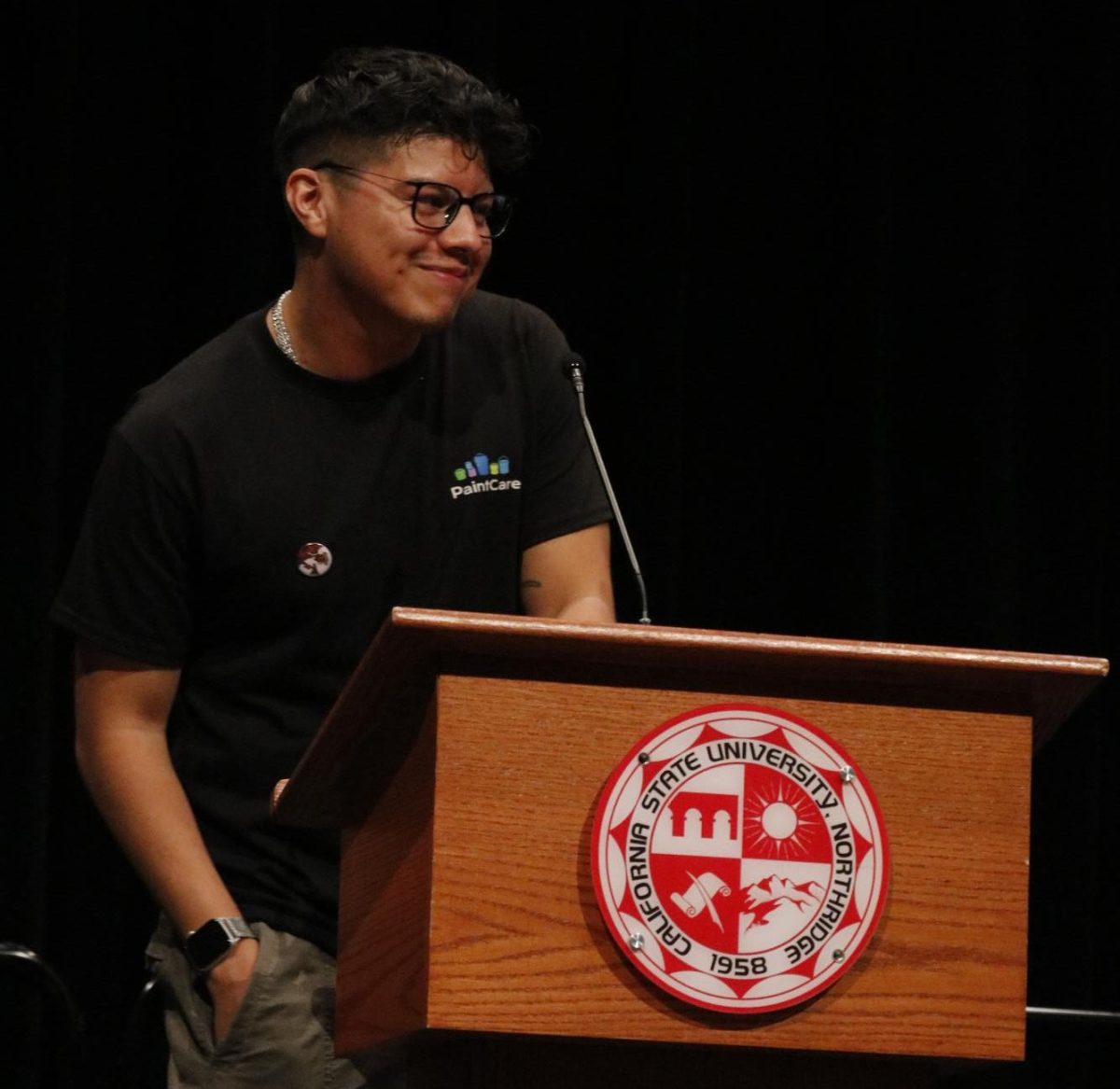

Hubert De Leon Tzic, 23, a CSUN grad with a B.A. in sociology, said he was fortunate enough to have received enough financial aid to cover the last five years of his tuition. He also worked during his academic semester to get out of school debt free.

“Given the circumstances President Obama should have done more to provide relief for recent graduate students,” he said. “Personally, I do not think this debt relief plan does much to provide the help necessary for graduate students to feel at ease with their debt. Unfortunately I have an overwhelming amount of friends who are in debt due to school loans and who have yet to find a stable job.”